💸 Lost money in crypto? We can show you how to save on your taxes!

Say goodbye to crypto tax confusion! Crypto Tax Report delivers precise tax reporting services for over 20 countries, making it a go-to resource for global investors. Our reports are tailored to meet the specific compliance requirements of each jurisdiction, ensuring that your cryptocurrency investments are accurately reflected in your tax filings.

and more.

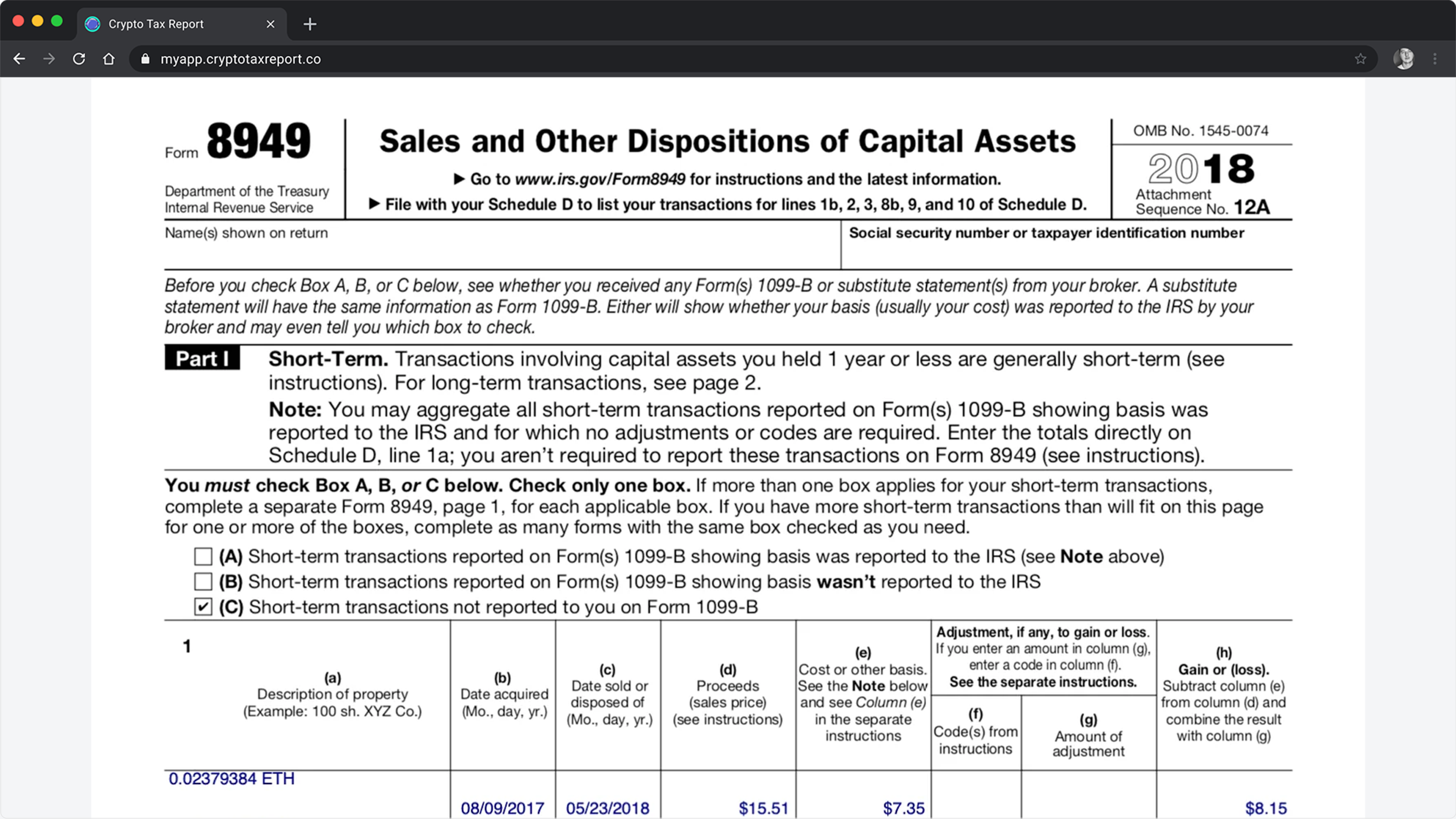

Looking for a cryptocurrency or Bitcoin tax report? Crypto Tax Report can create a ready-to-file, pre-filled Form 8949 & Schedule D for the IRS. Have crypto income as well? Secure Crypto Tax Report’s Income Tax Report to obtain the necessary numbers for your tax return, including Schedule 1 (Form 1040).

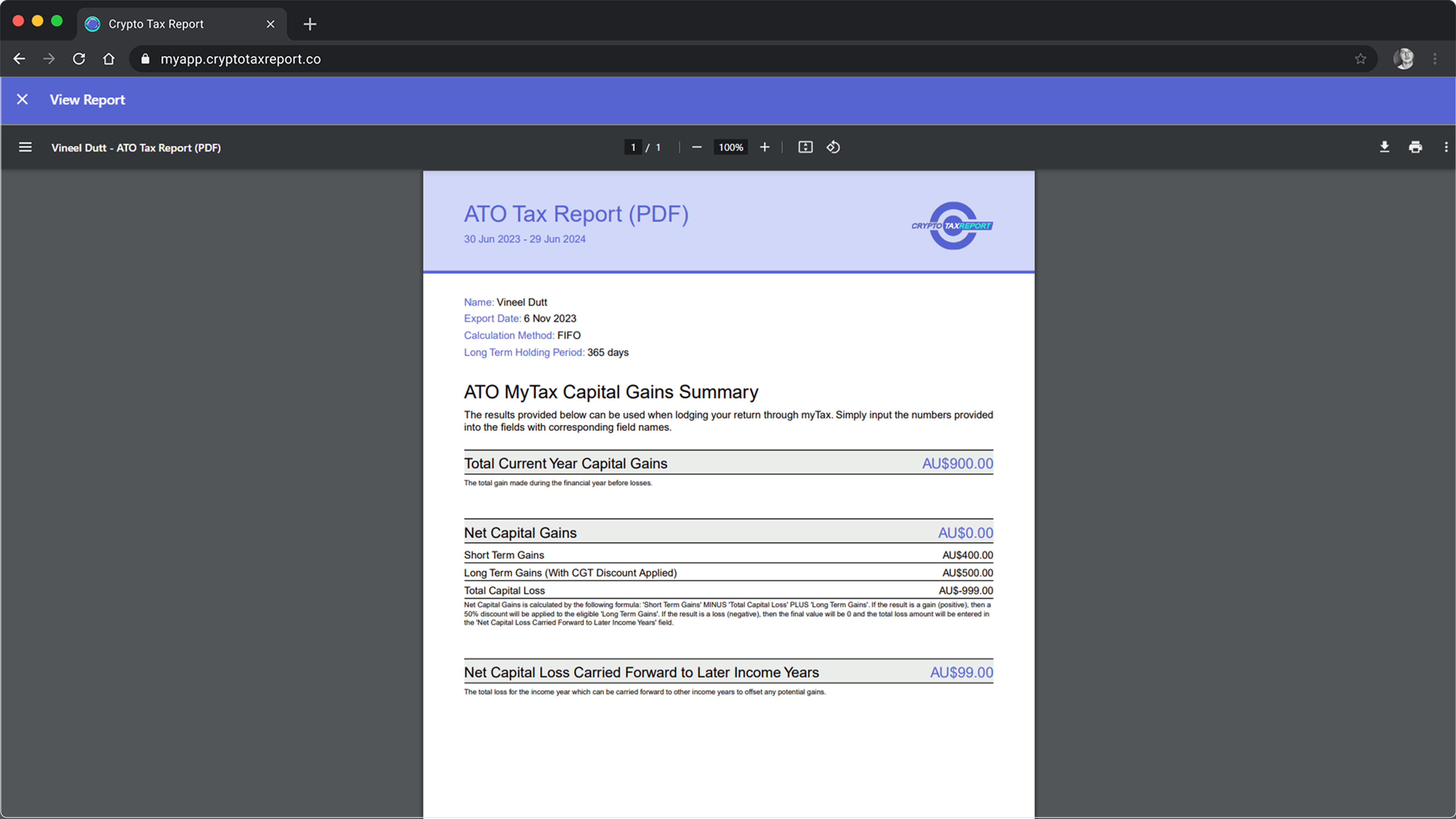

Crypto Tax Report’s ATO myTax document provides precise numbers to directly transfer into your myTax platform, detailing your capital gains pre-deductions, net capital gains post-losses, and your net capital gains with the 50% long-term CGT discount applied.

Crypto Tax Report supports 80+ English-speaking countries globally — only the most common ones are listed on the site. If your country uses any of our supported cost basis methods (such as FIFO, LIFO, etc.) then we can help you with your crypto taxes!

Our Capital Gains Report is suitable for anyone looking to declare crypto income on their taxes – no matter which country.

Would you rather file with TurboTax than navigate the maze of IRS paperwork? Crypto Tax Report simplifies the process with a specialized TurboTax Report. Easily download and import it to your TurboTax account for filing – it’s compatible with both the online and desktop versions. Plus, our dedicated help guides and instructional videos ensure a smooth filing experience with TurboTax, whether you’re in the USA or Canada.

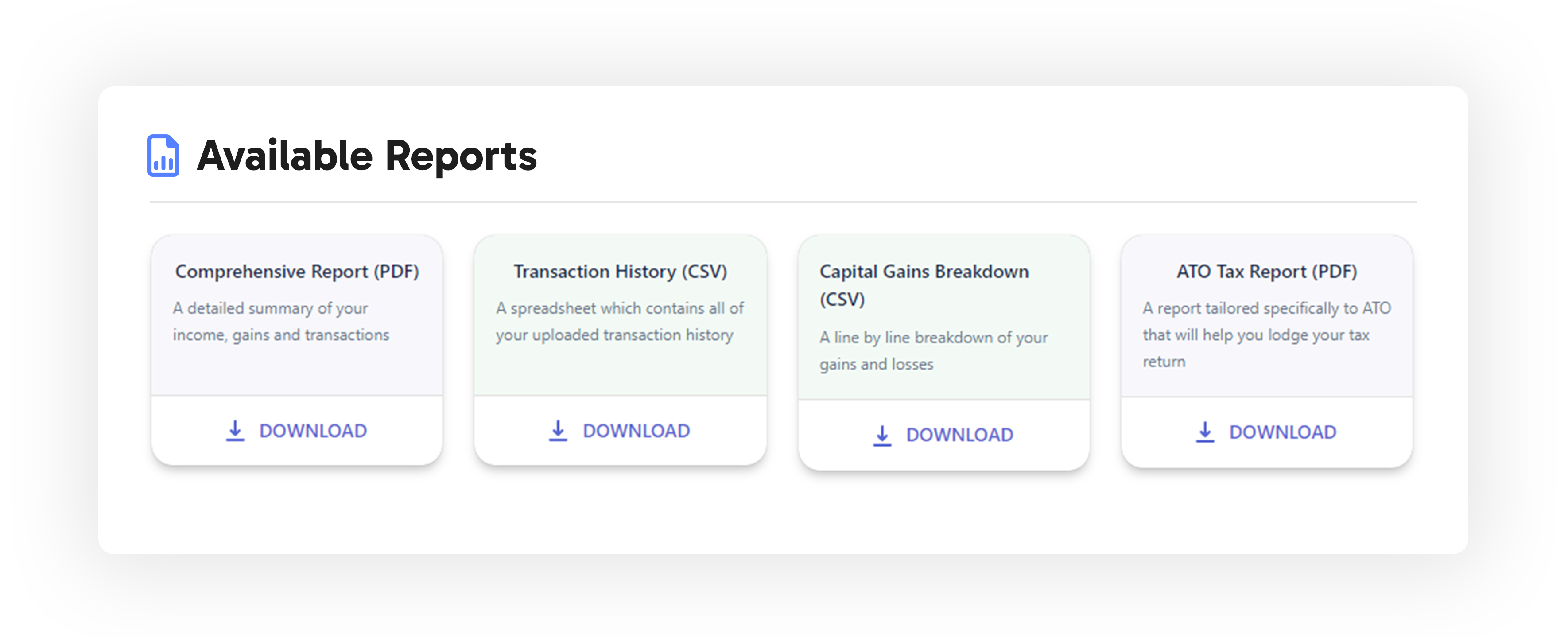

Unlock the simplicity of comprehensive crypto tax reporting with our All-in-One Reporting Solutions. Seamlessly consolidate all your cryptocurrency transactions into a single, detailed report that caters to your specific tax needs, whether for personal filing or professional accounting. Navigate your tax obligations with ease, no matter the complexity or volume of your trades.

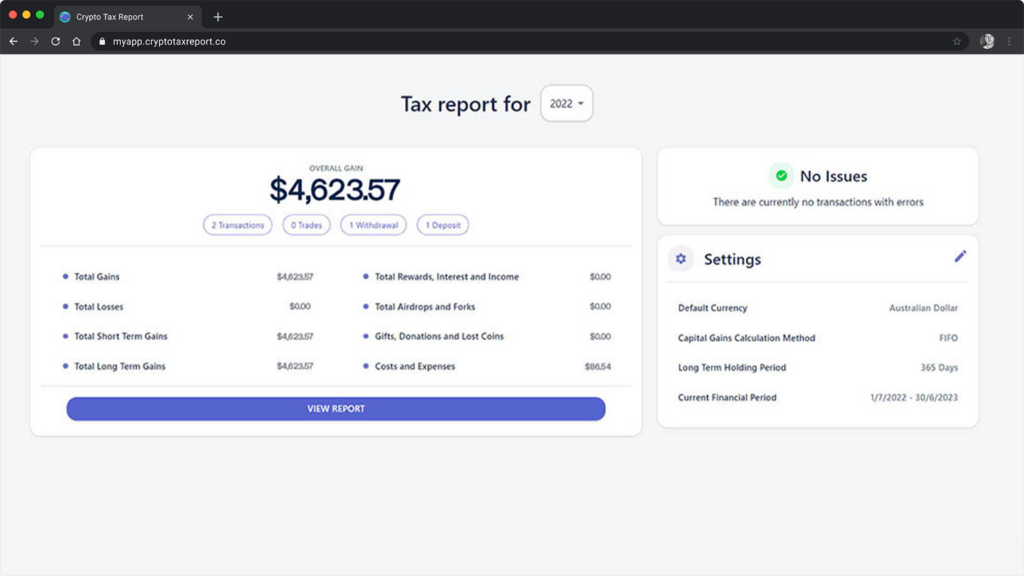

Navigate the intricacies of your crypto earnings and capital gains with precision. We offer nuanced insights and accurate computations of your cryptocurrency profits and losses. From mining to trading, airdrops, forks, staking rewards, defi and other crypto income transactions, we can do it all. It’s time to understand the full financial picture of your crypto activities, ensuring you meet your tax obligations with confidence and clarity.