Crafted for every crypto investor globally. Crypto Tax Report is your versatile and reliable tax companion, irrespective of where you’re based.

The ATO taxes cryptocurrency as property. That means cryptocurrency is subject to capital gains and income taxes.

Remember, major exchanges operating in Australia are required to abide by Know Your Customer laws. The ATO has access to the information you used when you signed up for these services.

To do your crypto taxes, you’ll need to keep a comprehensive record of all of your cryptocurrency disposals and income events.

This can be difficult to do manually. That’s where Crypto Tax Report comes in handy!

There are situations where you may need to pay taxes even if you don’t ‘cash out’ to fiat currency. Remember, earning cryptocurrency rewards and trading your coins for other cryptocurrencies are both considered taxable events.

With Crypto Tax Report, keeping a record of all of your taxable events has never been easier. Simply import your transactions and we’ll take care of all of the calculations!

To calculate your taxes on crypto-to-crypto transactions, you’ll need to know the fair market value of your coins in AUD terms at the time you received them and the time you disposed of them. This can be difficult to determine since most exchanges denominate crypto-to-crypto trades in cryptocurrency.

Crypto Tax Report can help. Our historical price engine can help you instantly find the fair market value of your cryptocurrency at the time of your transaction.

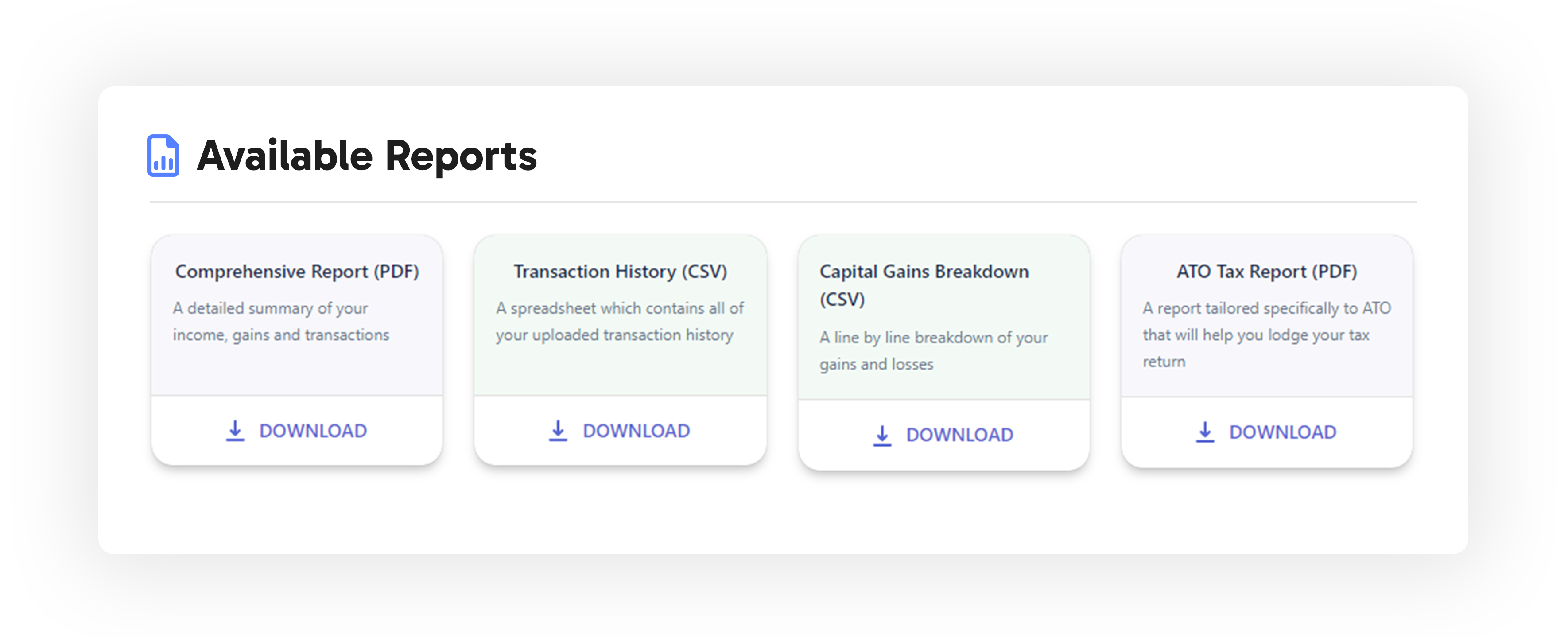

Yep! You can use Crypto Tax Report completely for free to view your capital gains and loss, and track your portfolio as long as you have less than 100 transactions per tax year.

If you have more than 100 transactions, we have plans available for purchase for any amount of transactions. You can view them here.

If you haven’t generated any tax reports, We offer a 14-day money-back guarantee, ensuring your satisfaction. If you reach out to our support team within this period, you can receive a full refund without any hassle.

To get in touch with us, send us an email at hello@cryptotaxreport.co.